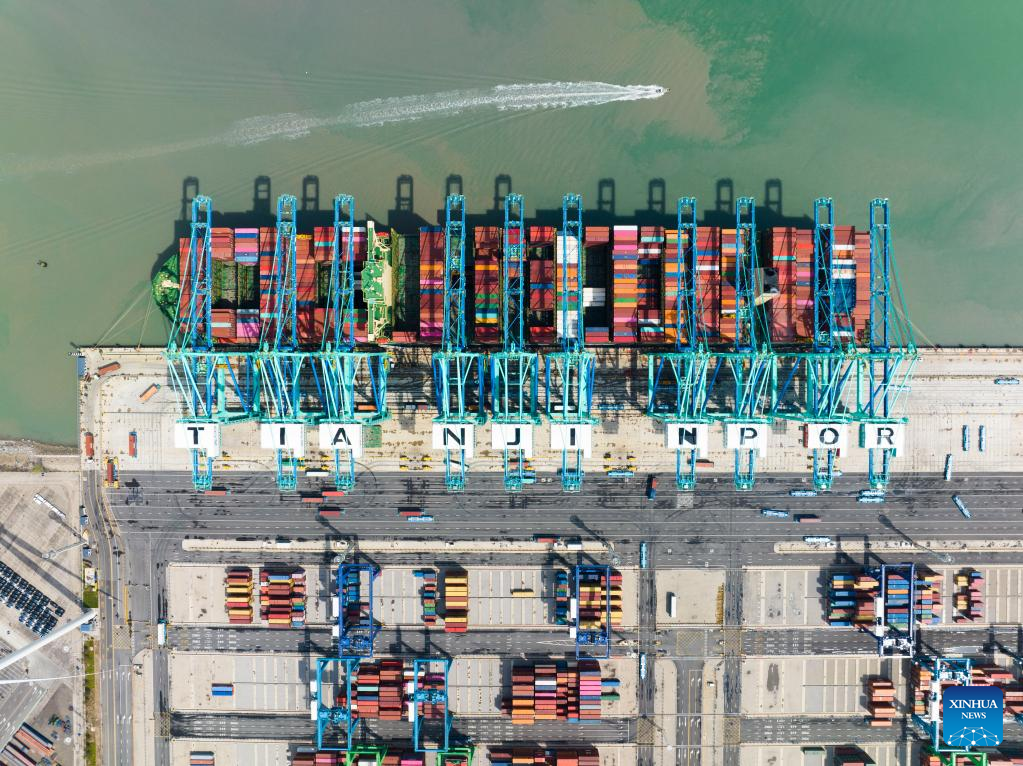

This aerial photo taken on April 6, 2023 shows a container ship at the smart zero-carbon terminal of Tianjin Port in north China's

When some US corporate executives recently visited Safewell, a manufacturer of high-security safes and vaults located in Ningbo, East China's Zhejiang province, the company's senior president, Wang Wei, showed them around the assembly lines and explained various application scenarios.

"We hope to work together to extend business and further open up the Asia-Pacific market in the future," said Wang, adding that such market expansion initiatives have been in full swing recently.

The company registered a 15 percent year-on-year increase in its first-quarter orders. Some of the new orders were placed by firms in Ireland, the United States and some Southeast Asian countries.

With external demand weak and other negatives emerging, including rising protectionism and geopolitical issues, Chinese exporters such as Safewell are ramping up efforts to expand their shipments. Some of their efforts have already generated success in the form of new orders.

Business leaders and trade experts said China's exports will likely continue growing despite challenges, and contribute to overall economic growth this year.

Yet, it is important for China to produce and export products the world needs to stabilize export growth. At the same time, the country must further tap potentials of both developed and emerging markets while making the most of new business models and novel business formats in the export sector, they said.

Citing Customs data from Yiwu, Zhejiang province, Chinese media outlet Caixin reported that in late March, around 800 container trucks completed Customs clearance procedures there per day, up from the average level of 400 in February.

With an abundant variety of commodities and convenient international logistics, Yiwu is often referred to as "the world's supermarket". It is also seen as a barometer of China's export activity.

Data from the General Administration of Customs showed China's goods exports increased 0.9 percent year-on-year to 3.5 trillion yuan ($511.4 billion) in the January-February period, beating market expectations. In the first quarter, the country's exports surged 8.4 percent year-on-year to 5.65 trillion yuan.

"With the global economy slowing, Chinese enterprises must take stronger measures to tap the potential of external demand to shore up exports' role in overall economic growth," said Ning Jizhe, deputy head of the Committee on Economic Affairs of the National Committee of the Chinese People's Political Consultative Conference, and vice-chairman of the China Center for International Economic Exchanges.

"China has the world's largest and most comprehensive industrial system. It can produce high-quality and cost-effective products the world needs. Chinese enterprises are very agile and flexible to adjust their products and services to meet new needs and demands as the external environment changes."

Xu Hongcai, deputy director of the China Association of Policy Science's Economic Policy Committee, said the dampening demand worldwide has been a major drag on China's foreign trade this year, and maintaining stable growth of foreign trade and balance of payments will be high on the country's agenda.

"On top of this, upgrading the quality of foreign trade should run in parallel. Chinese companies should improve the quality of their own products, so that other countries are willing to place orders. China should be ready to export quality products whenever the global market calls for them."

Safewell's Wang said the company is attuned to the situation, which is reflected in the upturn in new orders. He attributed this to efforts to complete long-needed upgrades during the COVID-19 period as the government rolled out a flurry of relief policies like financial support and tax and fee cuts. Such policies, he said, helped businesses such as Safewell to survive and thrive in trying times.

To be sure, Safewell faced hardship during the pandemic period. But, by leveraging tax breaks and extra deductions of R&D expenses, the company fully harnessed its adequate cash flow to upgrade existing products with additional features, to better meet customers' needs.

"The shutdown is not a boon to manufacturing plants, but that does not mean it is devoid of opportunity for plants to improve their products," he said. "When plants reopen, there will be a pent-up demand for products. Upgrades of products will pay for themselves many times over."

Wang said Safewell's new product, though priced higher than the previous version, has won broad recognition from its existing as well as new customers. Armed with orders from many firms this year, Safewell has gone in for mass production of the new product.

The company is not a case in isolation. Jia Shi Da Robot Technology, a robot manufacturer and exporter based in Taiyuan, Shanxi province, has shown that resilience and diligence do pay off.

In 2022, the company's sales hit almost 200 million yuan, with exports accounting for only 10 million yuan. Yet, during the first two months of the year, its shipments to overseas markets surged 200 percent year-on-year, and the company predicts its total exports this year will exceed 30 million yuan.

Jia Shi Da Robot said the surge in new orders is a result of its sharpened focus on research and development of new products, marketing innovation, and utilization of cross-border e-commerce channels, apart from the optimization of China's COVID-19 measures that has led to improvement in logistics and a revival of customer confidence.

Safewell's Wang said the company has sent its employees to Europe for market research to weather the difficulties arising from weakening global demand.

"I plan to visit the first-tier companies in the industry in the months to come to better understand the product needs of customers," he said. "We do not solely pursue quantity now, but constantly seek advances in technology, which will eventually help us gain a greater market share."

Experts said they expect Chinese enterprises to make better use of the benefits from the free trade agreements China has signed, especially the Regional Comprehensive Economic Partnership, to offset impacts from the weakening global economy and demand.

Gao Lingyun, director of the international investment division at the Institute of World Economics and Politics, which is part of the Chinese Academy of Social Sciences, said China serves as a core link on the industrial chain in East Asia and Southeast Asia, which makes the country better positioned to pool resources of all kinds together and maximize output.

Xu of the Economic Policy Commission said the diversification of international markets effectively reduces the dependence of foreign-trade enterprises on traditional markets and cushions the blow dealt by weakening external demand in the European and American markets.

For now, though the Association of Southeast Asian Nations' contribution to China's trade surplus is still limited, there is great potential for future growth that can be further unlocked, he said.

Jia Shi Da Robot said the tariff reductions under the RCEP, which took effect in January last year, have boosted its price competence in the Southeast Asian markets.

Customs data showed that during the first quarter, China's imports and exports with economies participating in the Belt and Road Initiative surged 16.8 percent year-on-year to account for 34.6 percent of its foreign trade, while trade with other participating countries of the RCEP rose 7.3 percent from a year earlier.

Yet, some labor-intensive industries like apparel and footwear still face huge downward pressure on exports, due to factors like the additional US tariffs and a decline in demand from developed economies facing high inflation and interest rate hikes, said Wu Dazhi, president of the Guangzhou Leather & Footwear Association.

The consumption slump in the Western countries has nearly halved their consumers' purchasing power for imported products in the apparel and footwear industry, he said, predicting China's exports of apparel and footwear will likely decline in the first half of the year.